The $8 Trillion Mobile Payment Boom: Redefining Mobile Gaming And Other Markets In 2024

Paying with a smartphone has shaped a new reality where the mobile payments industry reached new peaks this year, and it is expected to hit $8 trillion by the end of 2024. This is happening in an environment where global e-commerce is thriving, and even the market giant Amazon is facing some tough competition in different countries. The connection is so tight that mobile payment peaks are significant during occasions like Thanksgiving, Black Friday, Cyber Monday, and so on. However, the rise of digital wallets and a simplified mobile payment system has helped many users conduct their transactions easily in other industries too like mobile gaming and streaming.

While the contribution goes to all sectors and industries, most of the credit goes to mobile gaming and streaming. This is because the advancements in mobile payment systems have made it easier to access these spaces and invest more time and money. When we analyze expert opinions, the role of mobile and online casino gaming is usually emphasized because these platforms have enough money to invest in the best possible innovative payment options to make the user experience smooth. On the other hand, if there is a concern about mobile payments it’s mostly related to security issues. Given that innovative technologies enhance security measures, the investment of gaming companies aligns with the perspectives people want to ensure in digital payment options.

The rise of mobile gaming started in the early 2000s with the popularity of simple games like Tetris and the famous Snake. However, it was popular back in the 2010s with games like Angry Birds, and since then, many games have come forward showcasing different innovations and playstyles for other players. Since a gamification element along with in-game purchases was introduced, people started paying within the game to increase their odds of winning. The further development of digital casinos made digital payments a two-sided road where users could not only pay but also receive transactions from gaming platforms.

In the context of mobile casino platforms, user trust is crucial. This means secured payment systems, fewer cheaters, transparent rules, etc. This gave a demand for highly secure and fast payment systems that give players the flexibility of choosing between different payment modes and give businesses more revenue as more players use their services to conduct transactions. The innovation in making mobile payments more frictionless with in-app purchases, subscriptions, and rewards made the whole casino experience much more safe and engaging. Players can quickly deposit funds, access games, and withdraw winnings—all within minutes.

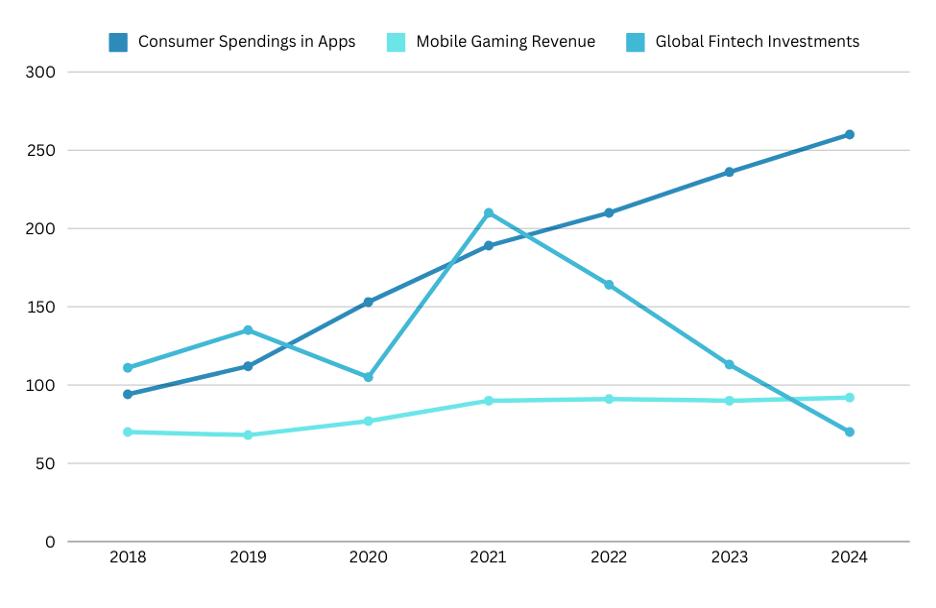

Chart 1: The Intersection of Mobile Gaming, Fintech Investments, and Consumer Spending (2018–2024)

The data highlights how fintech investments peaked in 2021, driving innovations in digital payment systems that enabled significant growth in app spending and mobile gaming revenue. While those investments declined post-2021 due to economic challenges, consumer spending and mobile gaming revenue maintained resilience, showcasing the lasting impact of earlier fintech advancements on the digital economy, as well as the consistent demand in mobile payments and gaming.

These are not just facts - the numbers don’t lie. This ease of use gives a higher retention rate for casinos which can directly cause an increase in revenue. In 2024 alone, the mobile casino valuation reached $47 billion, and when combined with other emerging payment factors like blockchain and cryptocurrencies, the number is expected to grow even further. In fact, those two are usually discussed in the context of encryption. Both users and experts find it important to enhance payment security, but the majority is convinced that in the digital age, encryption is not a standout feature but just an expected standard that has to be ensured.

Streaming platforms were a huge hit in times of COVID-19 when the limited mobility and restrictions gave a demand for not only having a dedicated streaming space at home to watch the latest streaming hits but also more flexible payment options for entertainment. Mobile payment systems rapidly evolved to integrate features like one-tap payment options and EMIs so that users can subscribe, upgrade, or cancel with ease. The ease of use is what gave streaming platforms one billion subscribers at its peak.

This doesn’t just streamline the payment process alone; it also creates new business models. Nowadays, many streaming services offer pay-per-view content, live events, and tipping features that have become more accessible with smart ways of payment. Back in 2022, Twitch - a major video streaming platform, published a post answering the question “How To Tip on Twitch?”. As viewers discovered the new way of paying their favorite streamers, the latter ones went to online forums to find the answer to “How to set up donation buttons securely?”. These parallel trends meet at the point where entertainment, mobile payments, and security cross their paths.

Jared Weitz, CEO of United Capital Source, told Forbes, “Mobile payments have not only made transactions faster and more secure but have also helped small businesses grow by enabling them to reach a wider customer base”. This goes on to show that mobile systems have acted as a bridge between simple financial transactions to a growing demand of customer base.

The innovations in mobile payments and financial literacy greatly benefited those nations where banking infrastructure is limited, but entrepreneurs try their best to establish businesses, using the helping hand of technology. For example, mobile payment transactions grow by over 20% annually with services like M-Pesa in Sub-Saharan Africa. Our analysis shows that a part of the positive perception about mobile payments is related to its ability to thrive in emerging markets. The case study of Kenya presents a good example of a country that leads the digital transformation in the continent.

It’s worth mentioning how many mobile apps and subscription platforms have capitalized on this opportunity giving out different models than seen in other countries. There are low-cost subscription models, lightweight apps, and offline playback options to help users with limited internet access. Due to these benefits, mobile games including digital casinos have also become popular with localized games and payment systems.

Since users are the main gap between mobile payment systems and their actual use with financial transactions, current trends show the value of mobile payments both for customers and businesses operating locally or globally. Our research on media publications and expert opinions reveals a picture where in the majority of cases mobile payments receive positive feedback, and a relatively smaller group of people stay neutral although emphasizing the fact that digital payments bring safety and security concerns with them.

Mobile gaming platforms lead the charge in payment transformation, offering seamless and secure transactions that redefine user experiences. While encryption and secure payment options have become standard expectations, these platforms bear the responsibility of continually advancing security measures to ensure trust and long-term success. As blockchain technology occupies a central part in new technologies, and AI is experimenting with new fields of operations, the question is not about the dominance of mobile payment anymore but how deeply will businesses harness the potential of those technologies